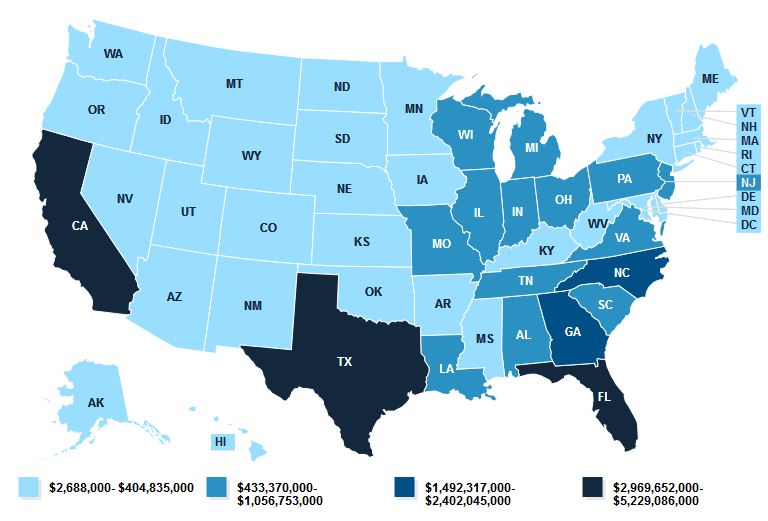

ACA marketplace enrollees receive $32.8 billion in tax credits

New data shows an estimated 9.4 million people who purchased health plans through Affordable Care Act marketplaces will receive about $32.8 billion in tax credits for 2016.

Should the ACA be repealed, those credits would go away.

Under the health law, people with low or moderate incomes are eligible for tax credits to help cover the cost of monthly premiums for health plans purchased through marketplaces. In Washington, those plans are purchased through Washington Healthplanfinder.

The new data from the Kaiser Family Foundation includes estimates of the total amount of tax credits received in each state for 2016, based on the average tax credit per person and the number of people receiving credits, as of March 31.

The average monthly tax credit nationwide is $291. With nearly 9.4 million people receiving credits, the total amount is about $32.8 billion, according to the data.

In Washington, the average monthly tax credit is $238. About 110,500 people in the state receive those credits, for a total of about $315.5 million in tax credits.

Alaska has the highest average monthly tax credit ($750), followed by Wyoming ($459), North Carolina ($401), West Virginia ($388) and Louisiana ($362).

The average monthly tax credit in Oregon is $253. There, about 95,500 people are enrolled in marketplace plans, for a total of about $290 million in tax credits.